Continued from a previous article

Bookkeeping Records 123 – Lewisville Outsourced Online Cloud Bookkeeping Services

In the evolving landscape of business, particularly for small to medium-sized enterprises (SMEs), the need for accurate and timely bookkeeping is paramount. Proper financial records form the backbone of informed decision-making, tax compliance, and overall financial health. As companies seek efficiency, cost-effectiveness, and convenience, many are turning to virtual bookkeepers, particularly those based in the United States. Moreover, the adoption of apps to expedite paperwork and streamline processes has become an essential part of modern financial management. This article outlines the advantages of hiring a US-based virtual bookkeeper and using technology to enhance bookkeeping and paperwork efficiency.

Why Bookkeeping Matters

Bookkeeping is a vital business function that ensures the accurate recording of financial transactions. This data helps businesses analyze their performance, manage cash flow, and make informed decisions. However, maintaining an in-house bookkeeping team is not always feasible or cost-effective for many businesses, especially startups or SMEs.

In response to these challenges, virtual bookkeeping services have emerged as a popular solution. These services offer businesses the opportunity to outsource their financial management needs to professionals who work remotely. While virtual bookkeepers can be found globally, hiring a US-based virtual bookkeeper offers several unique advantages that are worth considering.

Benefits of Hiring a US-Based Virtual Bookkeeper

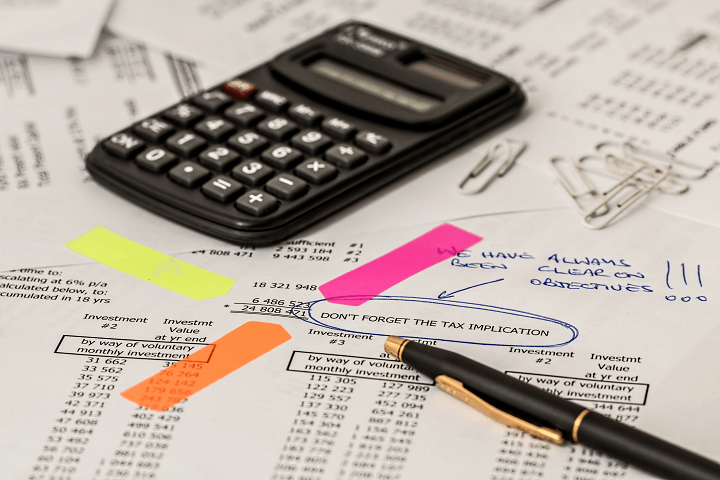

Familiarity with US Tax Laws and Regulations

US-based virtual bookkeepers possess a distinct advantage when it comes to navigating the complexities of federal and state tax regulations. The US tax code is intricate, and regulations differ from state to state. A US-based bookkeeper will be intimately familiar with local, state, and federal requirements, ensuring your business remains compliant with IRS regulations. This expertise reduces the risk of costly errors, such as under reporting income or mishandling tax deductions.

Furthermore, US-based virtual bookkeepers are typically knowledgeable about the latest updates and changes in tax laws. This ensures that your business is always up to date with tax filings and is taking advantage of all available deductions and credits.

Time Zone Convenience and Communication

While virtual bookkeepers can be found in any part of the world, the convenience of working with a US-based bookkeeper cannot be overstated. Operating within the same or a similar time zone significantly simplifies communication. With the availability of real-time communication, you can address urgent financial matters without worrying about delayed responses due to time differences.

Moreover, a US-based virtual bookkeeper is more likely to be proficient in your preferred business language, which eliminates any potential communication barriers and ensures smooth, professional interactions. Clear communication leads to fewer mistakes and greater efficiency.

Knowledge of Industry-Specific Bookkeeping Standards

Different industries have specific accounting and bookkeeping standards that must be adhered to, whether it’s retail, healthcare, construction, or technology. A US-based virtual bookkeeper will be well-versed in the unique requirements for your industry, such as GAAP (Generally Accepted Accounting Principles), revenue recognition methods, or sales tax collection procedures.

Their familiarity with the legal and financial standards that apply to your business reduces the risk of non-compliance and ensures that your financial records are accurate and suitable for audits, financing opportunities, or investor reviews.

Faster Onboarding and Familiarity with US Financial Tools

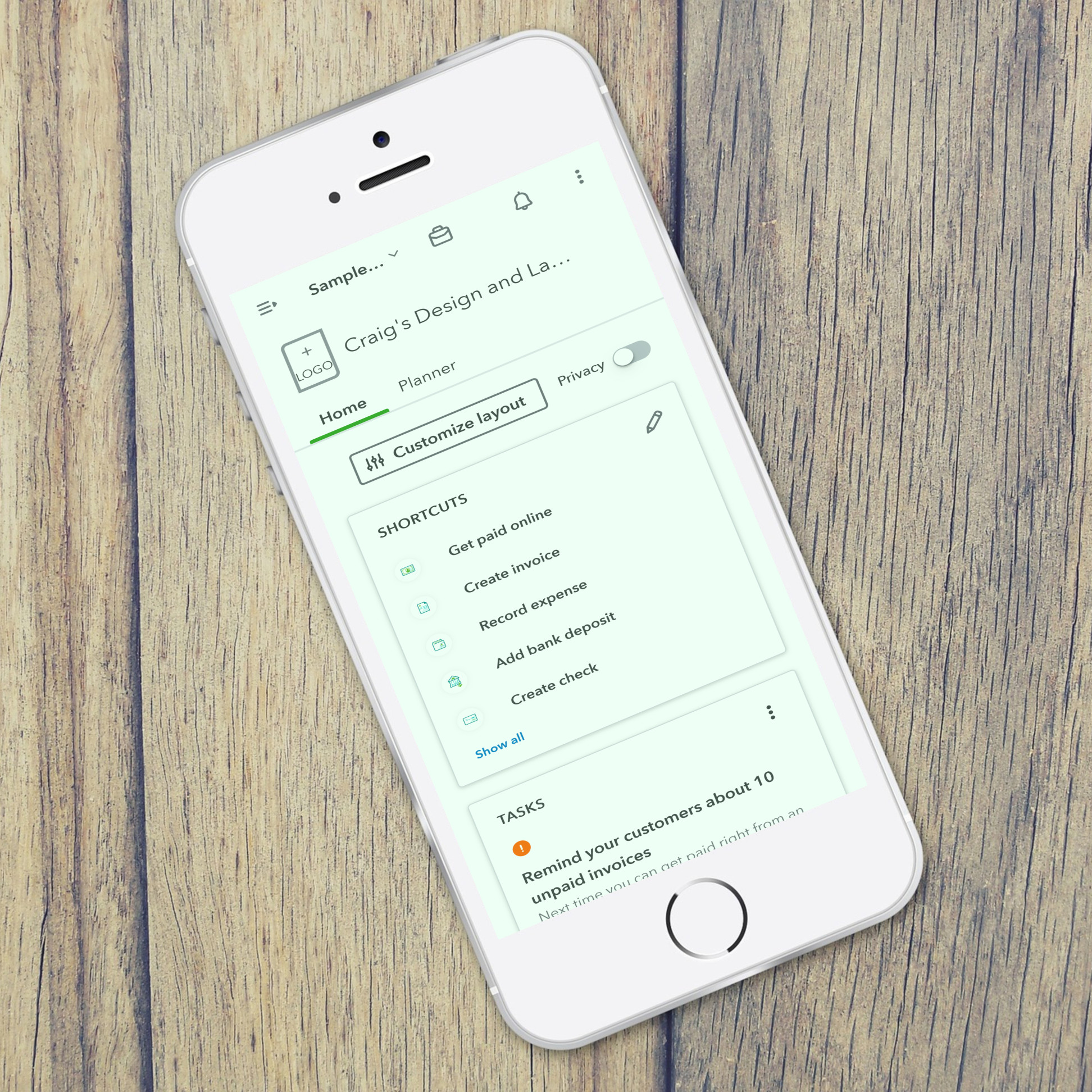

When you hire a virtual bookkeeper based in the US, they are likely already familiar with the popular financial tools and software used by American businesses, such as QuickBooks. This reduces the learning curve and ensures they can hit the ground running. They are also adept at integrating with US-based banks, payroll systems, and tax software, making them a seamless addition to your financial management team.

Data Security and Confidentiality

Financial data security is of utmost importance in today’s digital world. A US-based virtual bookkeeper is subject to US data protection laws, which include strong regulations on how financial data is stored and handled. The importance of protecting sensitive data cannot be overstated, and working with a bookkeeper who understands US-specific regulations, such as those under the Gramm-Leach-Bliley Act or HIPAA, is crucial for businesses in industries that handle confidential information.

Conclusion

Hiring a US-based virtual bookkeeper and leveraging modern bookkeeping apps can be a game-changer for businesses looking to streamline their financial management processes. The expertise of a US-based professional, coupled with the convenience of digital tools, allows for greater efficiency, improved accuracy, and enhanced compliance with tax and regulatory requirements.