While the advantages of a US-based virtual bookkeeper are clear, technology plays a complementary role in enhancing the efficiency of bookkeeping services. The use of modern apps and automation tools in the bookkeeping process is rapidly transforming the way businesses manage paperwork. These tools not only save time but also improve accuracy and organization.

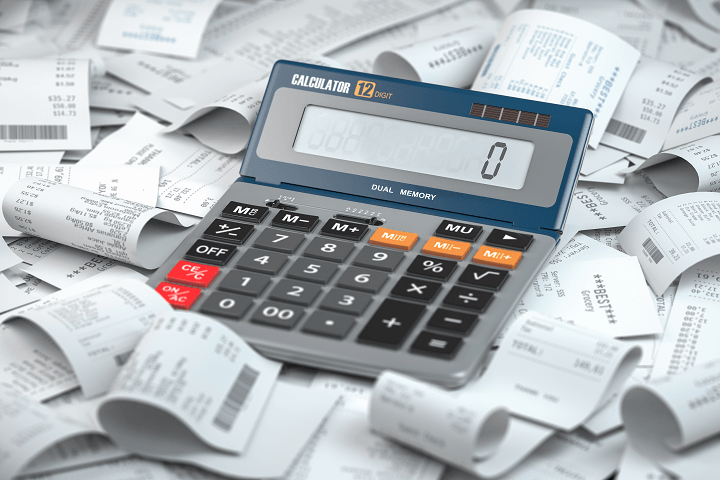

Automation of Routine Tasks

Bookkeeping apps, such as Expensify, Hubdoc, or Receipt Bank, can automate the collection, sorting, and categorization of receipts and invoices. These apps use OCR (Optical Character Recognition) technology to scan and digitize documents, automatically syncing with your bookkeeping software. This eliminates the need for manual data entry, reducing errors and freeing up your bookkeeper to focus on more critical tasks, such as financial analysis or strategic planning.

For example, apps like Bill.com automate bill payments and invoicing, sending reminders and tracking due dates, which helps avoid late payments and potential penalties.

Real-Time Financial Updates

Cloud-based bookkeeping tools enable businesses to receive real-time updates on their financial status. Using QuickBooks Online allows virtual bookkeepers to manage financial data from anywhere, keeping the client informed with up-to-the-minute reports. This platform provides customizable dashboards that can track cash flow, outstanding invoices, and other key financial metrics.

With real-time updates, both you and your bookkeeper have access to the same information, which ensures transparency and allows for proactive financial management.

Advantages of Leveraging Apps Streamlined Paperwork

Modern bookkeeping apps integrate seamlessly with a variety of other business tools, from payroll platforms like Gusto or ADP to CRM systems like Salesforce or Zoho. This integration ensures that your virtual bookkeeper can easily access all relevant financial data from a central hub, streamlining workflows and reducing the risk of data silos. QuickBooks Online offers optional fully integrated payroll and payments processing in one place, further streamlining workflows.

Having , a payroll app that syncs directly with your bookkeeping software ensures accurate wage reporting and tax withholdings, eliminating the need for manual data entry.

Cloud Storage and Document Management

Cloud-based solutions not only ensure that financial documents are easily accessible but also eliminate the need for physical paperwork, reducing clutter and the risk of lost documents. Tools like Google Drive, Dropbox, or OneDrive allow for secure sharing of documents between you and your virtual bookkeeper.

Additionally, many apps offer secure backups of financial data, protecting your business against data loss due to hardware failure or cybersecurity threats. With secure encryption, cloud storage ensures that sensitive financial data is safe, while also providing easy access from anywhere with an internet connection.

Conclusion

By combining the expertise of a US-based virtual bookkeeper with the power of bookkeeping apps, businesses can focus more on growth and less on paperwork. In the fast-paced world of business, these tools and services provide the edge needed to maintain financial health, stay compliant, and make informed decisions with confidence.